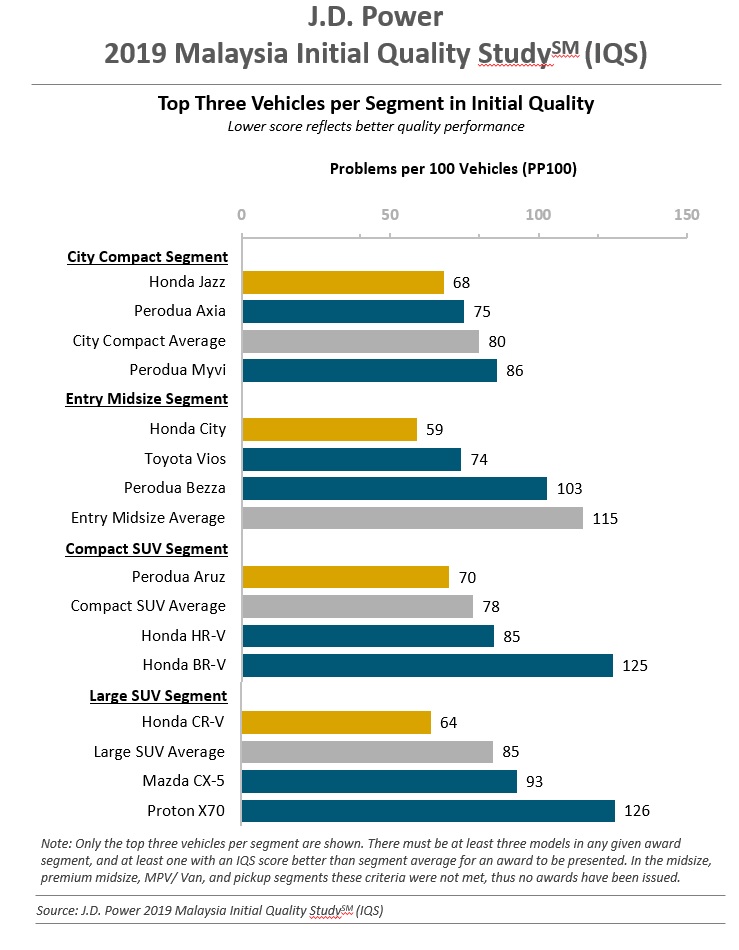

The latest JD Power Initial Quality Study (IQS) for Malaysia which provides insights into the problems faced by owners of new vehicles shows that they are experiencing fewer problems than in 2018. This is largely attributed to a decline in manufacturing-related issues and prevailing problems are nearly equally split between design and manufacturing categories.

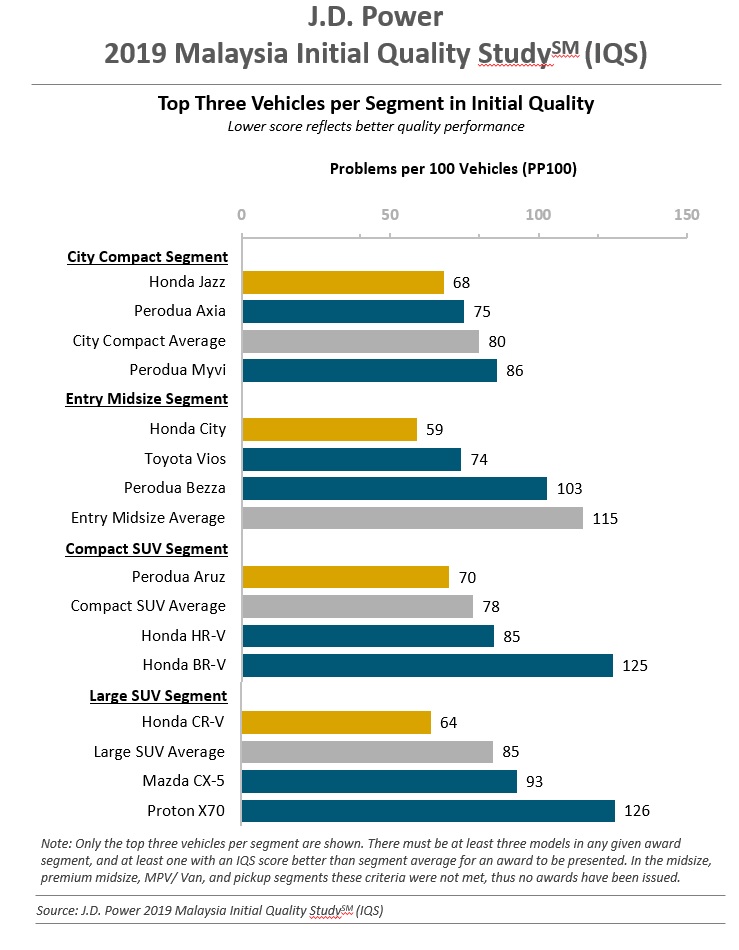

Initial quality measures the number of problems experienced per 100 vehicles (PP100) during the first two to six months of ownership, with a lower count reflecting higher quality. In this year’s study, the industry average decreased to 85 PP100, from 89 PP100 in 2018.

The study showed that the share of manufacturing-related issues has been on the decline over the past 3 years, falling to 51% in 2019 from 74% in 2016. The majority of the reduction from last year related to noise aspects, such as wind noise (-1.7 PP100); abnormal suspension noise (-1.1 PP100); seat noise (-0.9 PP100); abnormal transmission noise (-0.7 PP100); and other interior storage compartments noises (-0.3 PP100).

One-third of issues relate to noise

That said, noise-related issues accounted for 36% of all manufacturing issues identified by owners this year. On average, the overall rating on quality and reliability of new vehicle is lower among owners who reported such noise-related manufacturing issues than those who did not (7.3 and 8.2 respectively on a 10-point scale). Interestingly, engineers are some car companies have told PISTON.MY that Malaysians seem to have the ‘most sensitive’ ears as complaints about noise tend to be higher than from motorists in other countries!

“Vehicle owners continue to be sensitive to noise-related problems, which strongly affect their overall perception of the vehicle’s quality,” said E-Ling Cheah, Country Manager for Malaysia at J.D. Power. “Given the heightened customer sensitivity around buzz, squeak, rattle and wind noises, manufacturers need to not only improve their manufacturing processes but also work upstream to review and redefine vehicle design guidelines to avoid such issues surfacing early in the ownership cycle.”

Some key findings of the 2019 study

Among the top 5 problems, 4 were similar to the top 5 in 2018. Excessive wind noise (5.9 PP100) and excessive road noise (2.9 PP100) continued to be the top two most-cited problems. “Built-in Bluetooth Mobile Phone/Device Has Frequent Pairing/Connectivity Issues” became the third most reported problem (2.7 PP100), up from fifth last year (2.5 PP100). Radio problems were fourth this year (2.0 PP100).

Younger car owners cited more problems when responding. Those under 35 years old (57%) indicated more problems than those 35 years or older (91 PP100 vs. 73 PP100, respectively). Younger car owners cited more problems in the features/controls/displays (+4.6 PP100) as well as vehicle interior (+4.5 PP100) categories. Perhaps they have more sensitive hearing?

Among new vehicle owners who did not indicate any problems, 49% said they “definitely will” recommend their brand and model to friends or relatives, compared with 37% for those who had encountered at least one problem with their vehicle. One-third of new vehicle owners who did not experience any problems with their vehicle said they “definitely will” purchase a vehicle from the same brand the next time, compared with 26% of those who experienced at least one problem.

The J.D. Power 2019 Malaysia Initial Quality Study was based on responses from 1,904 new vehicle owners who purchased their vehicles between July 2018 and August 2019. The study, conducted between March and October 2019, included 50 passenger car, pick-up and utility vehicle models of 12 brands.

No more studies in ASEAN after 2019

JD Power has been conducting a series of three studies annually for the past 17 years but will no longer do so after this year. Reorganization sees the regional office in Singapore, which was responsible for the Malaysian market, shutting down. The company, founded in 1968, will focus on business activities in China and Japan from 2020 onwards.