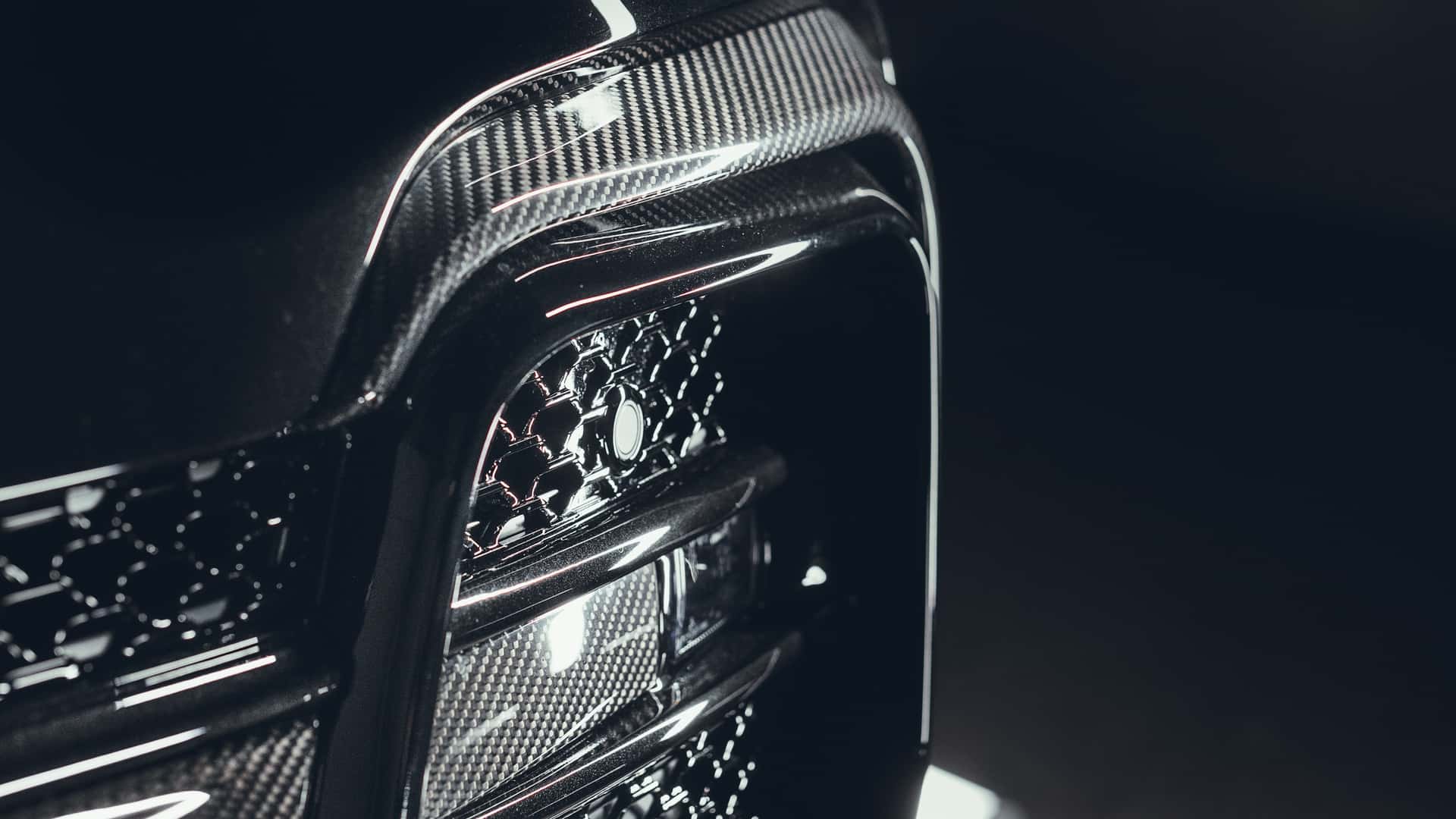

The legendary Mercedes-Benz SLR McLaren turns 20 this year, and to honour the milestone, McLaren hosted a number of high-profile models and commemorative events at its McLaren Technology Centre (MTC) in Woking, United Kingdom.

The SLR’s history began in the middle of the 1990s when McLaren and Mercedes-Benz were partners in Formula 1. The SLR is the result of the team’s desire to give customers a taste of its several successes (constructors’ champions in 1998, drivers’ champions in 1998, 1999, and 2008).

(more…)