A recent study conducted by Germany’s Kiel Institute for the World Economy reveals that China’s leading electric vehicle (EV) manufacturer, BYD Co., has received substantial direct government subsidies amounting to at least €3.4 billion (RM17.2 billion). This surge in aid is part of China’s strategic efforts to dominate the EV and clean technology sectors.

The report highlights a significant increase in subsidies for BYD, from €220 million in 2020 to €2.1 billion just two years later. Beyond direct subsidies, BYD benefits from additional support for local battery manufacturers and incentives for buyers of its vehicles. This financial assistance has allowed Chinese firms like BYD to rapidly expand their market presence, particularly in China, and increasingly penetrate European markets.

The European Union is currently investigating allegations of unfair aid practices within China’s EV sector. The report underscores concerns about the economic threat posed by an influx of Chinese-made products flooding European markets, prompting calls for trade rebalancing with China.

BYD, alongside fellow Chinese EV manufacturers Nio and Geely, is aggressively expanding into Europe after achieving significant success in the Chinese market. Meanwhile, Western manufacturers like Tesla and Volkswagen are facing intense competition in China’s fiercely competitive EV market.

According to the Kiel Institute, nearly all of China’s listed companies received direct subsidies in 2022, with substantial support also provided to industries such as wind, solar, and railway rolling stock. This level of industry aid in China far surpasses that of large EU and OECD countries.

In response to China’s aggressive subsidy programs, the EU has allocated funds to establish a €40 billion innovation fund aimed at enhancing competitiveness against Chinese counterparts. Additionally, the EU initiated a probe into whether Chinese subsidies provided unfair advantages to companies like BYD, SAIC, and Geely. Initial tariffs may be imposed as early as July.

China has defended its subsidy programs, asserting that its EV manufacturers’ success stems from superior products and technological innovation rather than solely relying on government support. Nevertheless, concerns persist about the impact of Chinese subsidies on global trade dynamics, prompting diplomatic efforts such as German Chancellor Olaf Scholz’s upcoming trip to China to address these issues.

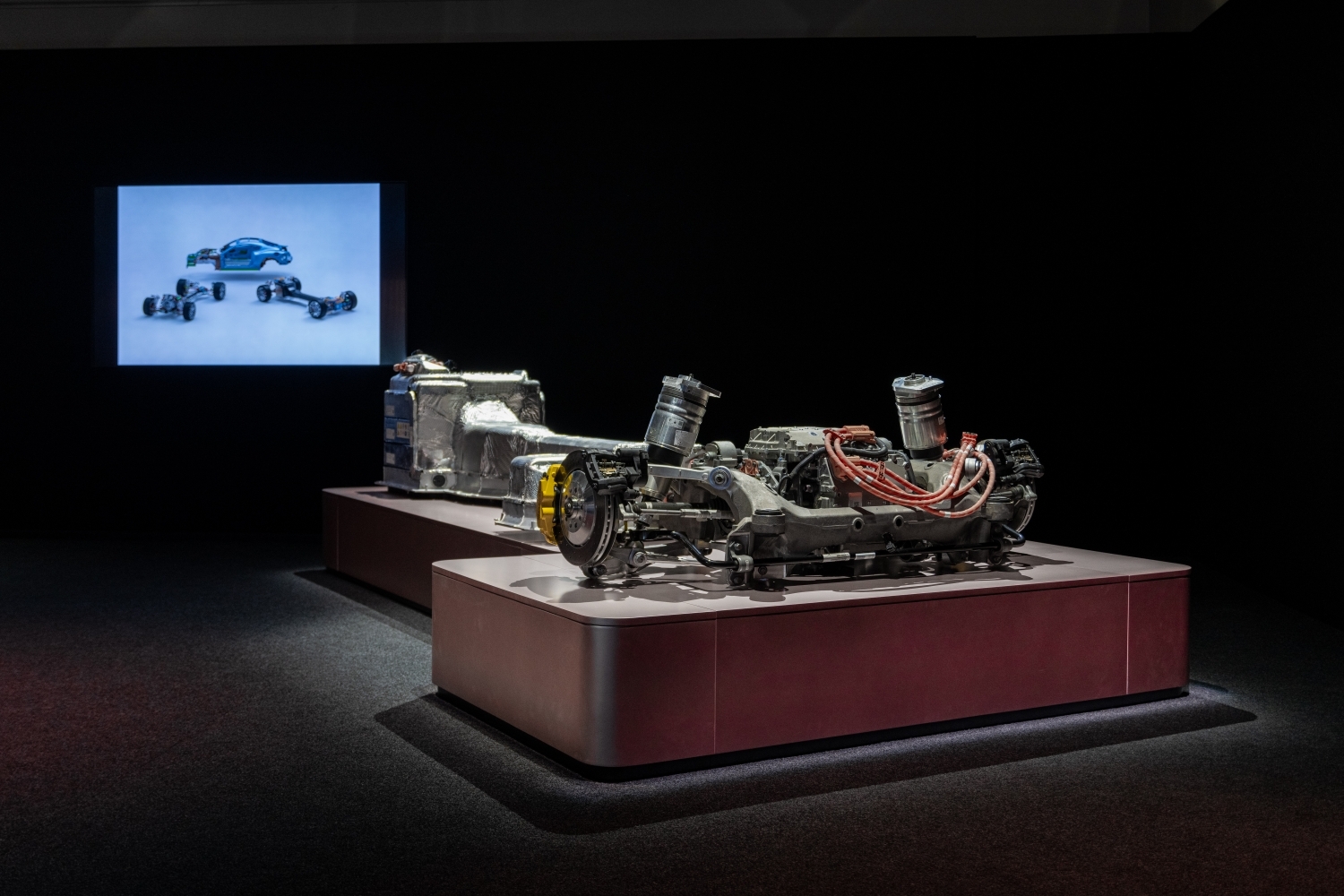

BYD’s evolution from a battery maker to a leading EV manufacturer underscores the transformative impact of China’s domestic EV market growth and supportive policies. With its ability to offer competitively priced vehicles, such as the Seagull hatchback priced under $10,000, BYD has disrupted traditional automotive markets and intensified global competition in the EV sector.