As Honda evaluates a potential merger with Nissan, the automaker is reportedly seeking an alternative strategy to bypass U.S. import tariffs. A key part of this plan involves purchasing hybrid batteries from Toyota’s upcoming North Carolina facility instead of sourcing them from overseas.

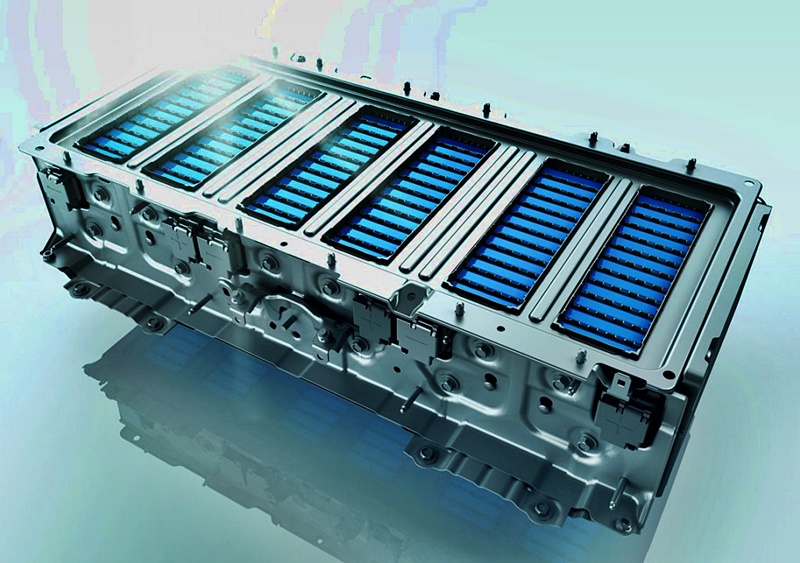

According to a report by Japanese newspaper Nikkei, Toyota has agreed to supply Honda with 400,000 battery packs annually, beginning in the 2025 fiscal year, which starts in April. This coincides with the launch of Toyota’s $14 billion battery manufacturing plant in North Carolina. The agreement, while significant, is not a strategic alliance. Honda will simply purchase the batteries from Toyota, with no reciprocal arrangement in place.

By securing a domestic supply of hybrid batteries, Honda aims to insulate itself from escalating tariffs imposed by the U.S. government. The company sold approximately 308,000 hybrid vehicles in the United States last year and intends to expand that number in the coming years. While specific models set to receive Toyota’s batteries remain undisclosed, industry speculation suggests that the popular CR-V hybrid could be among the first beneficiaries.

Currently, Honda imports hybrid batteries from Japan and China. However, the shifting trade landscape has made this approach increasingly untenable. In March 2025, the U.S. government implemented a 10% tariff on imports from China, compounding an earlier 10% tariff imposed the previous month. Additionally, Nikkei reports that the White House is expected to raise tariffs on auto imports from Japan from 2.5% to 25% in the near future.

The deal with Toyota presents a practical short-term solution for Honda, allowing the automaker to sidestep steep import tariffs on hybrid components. Alternatives such as absorbing the tariffs—resulting in reduced profit margins—or passing the costs to consumers—leading to higher vehicle prices—pose financial risks. Establishing an independent battery production facility in the U.S. would be a long-term solution but requires substantial investment and time.

For Toyota, the agreement represents an opportunity to recoup some of its investment in the North Carolina battery plant more quickly. While the automaker has been aggressively expanding its electrification strategy, this deal marks a rare case of cooperation between Japan’s two largest automakers in an otherwise fiercely competitive market.

Both companies have remained tight-lipped about the reported agreement. When approached for comment, a Honda representative declined to discuss the matter, while Toyota similarly stated, “We would like to refrain from commenting on individual transactions.”

Honda and Toyota are not alone in adjusting their supply chains to mitigate the impact of U.S. trade policies. German automakers such as Porsche and Audi are reportedly considering U.S. production facilities, while Volvo recently delayed the launch of the EX30 in response to a 100% tariff on Chinese-made EVs. As trade tensions continue to reshape the global automotive industry, manufacturers are increasingly seeking localized solutions to maintain competitiveness in key markets.