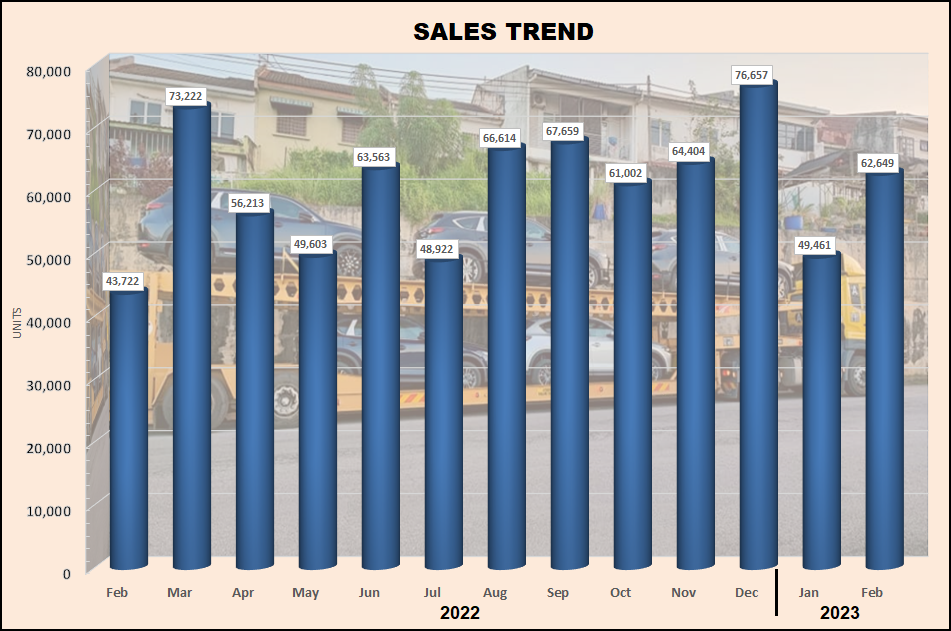

The first month of the year was a short sales month due to the Chinese New Year festive season, partly the reason for the 35% drop in the Total Industry Volume (TIV) of new vehicles delivered. However, it was not an unexpected drop after the exceptional high of December which recorded the highest sales volume in 2022.

February is also a short month, some years made shorter by festive holidays, so it is also not a month when high numbers are expected. Nevertheless, February saw a jump of 27% from the January TIV to close at 62,649 units.

The rise was also attributed to the push to deliver vehicles to customers who had made their bookings before June 30 last year, which entitled them to exemption from sales tax. The surge in orders in June last year coupled with the disruption of production due to parts shortages had caused a long backlog. Under normal circumstances, the car companies would just deliver as fast as their plants could supply. But this time, it is more urgent to meet a deadline for delivery, otherwise the vehicles will incur sales tax.

Many companies have reported that they will be able to complete all deliveries by the end of this month. A few say that there are some customers whose orders will not be fulfilled by the deadline. Perodua has made a decision that it will absorb the sales tax payable for those customers who do not get their cars in time. Another company said that it has been in contact with affected customers and come to an agreement on other forms of compensation (though absorbing the sales tax is too high for the company).

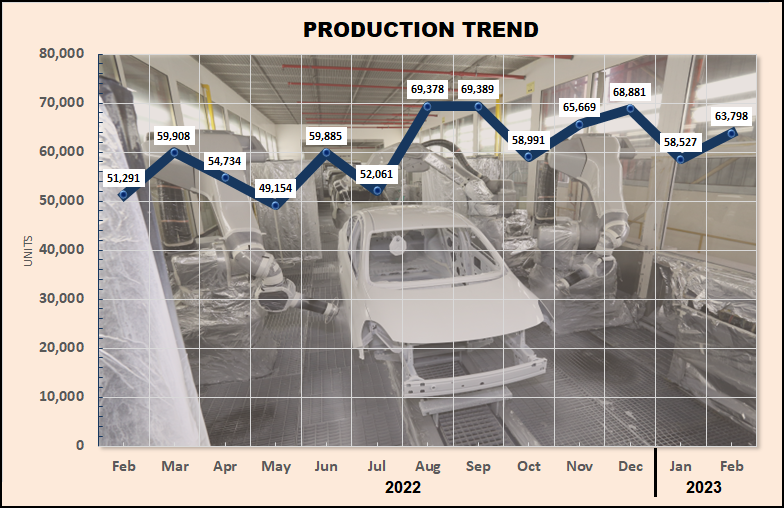

The big push to complete as many vehicles as possible saw production also increased, by 9% to almost 64,000 units. Fortunately, the parts situation has stabilised and more vehicles can be completed for delivery but some plants still report that there are occasional shortages.

Anyway, just like the time when massive floods in Thailand (in October 2011) disrupted production so severely – affecting other markets in the region as well – the carmakers have since taken a deeper look at establishing additional supply sources so that they are not caught again.

And to make things worse, there are also many more electronic systems in cars which require microprocessors, which are in short supply at times. A modern car can have anything from 1,400 to as many as 3,000 microprocessors for the various systems managing the engine, the infotainment system and safety systems. For electric vehicles, there would be even more reliance on such items.

March numbers will be higher as there will be the final month of delivery and there are also promotions on. In the past, the period before festive seasons would see a boost in sales as people may have wanted a new car to celebrate. But for many years now, this has not been the case and furthermore, the long waiting periods may also deter some people from ordering a new car so soon since they can’t get it within a few weeks anyway.

Looking ahead, the car companies will be watching what happens after March when the backlog starts to decrease as other orders are fulfilled. There is a cautious attitude in planning; although the TIV for the year may be just a bit higher, the demand may not be strong so marketing budgets are being adjusted accordingly.