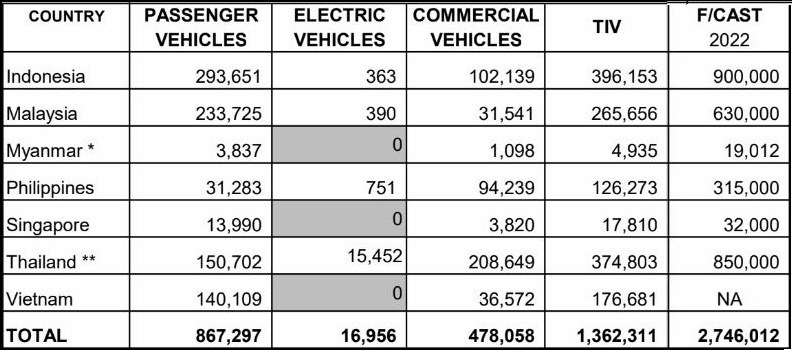

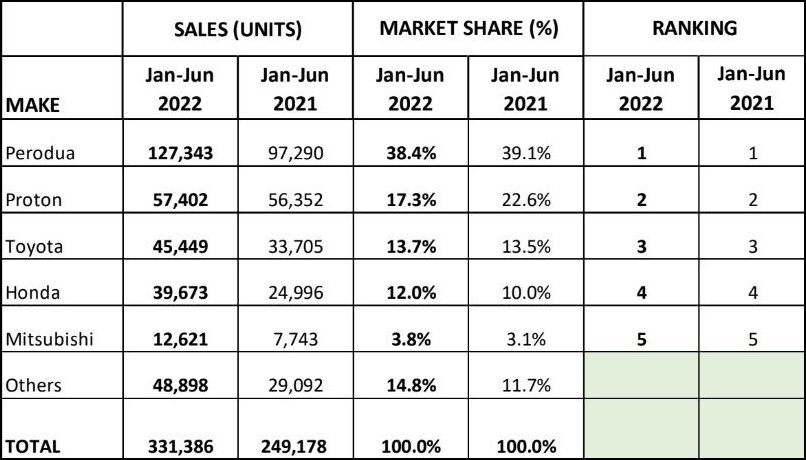

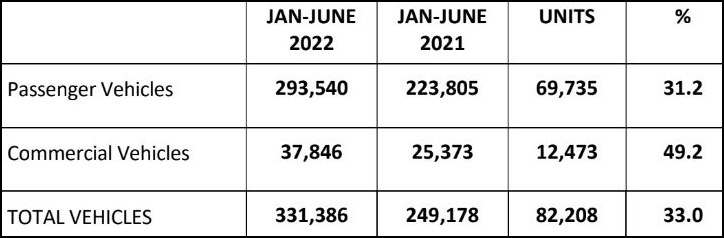

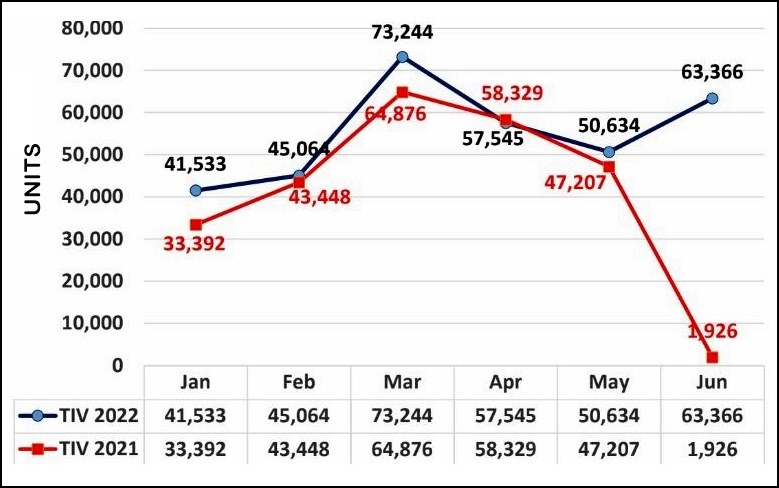

While 2021 was a difficult year for the car companies, 2022 has seen significant increase in volumes in spite of the ongoing supply shortage of certain parts, limiting output from the plants. According to the Malaysian Automotive Association, which has been compiling industry data since 1967, the Total Industry Volume (TIV) in the first six months of 2022 was 331,386 units, an increase of 82,208 units or 33%.

This big increase is attributed to the pent-up demand for new vehicles but it has also to be noted that the TIV for the same period in 2021 was low due to the restrictions of the Movement Control Order (FMCO) in June 2021. As can be seen in the chart, the strict restrictions saw a sharp drop in sales.

Following the government’s decision of not extending sales tax exemption incentive for passenger vehicles (under the PEMERKASA+ package) after June 30, 2022, bookings surged as those who wanted to beat the deadline rushed to place bookings for new vehicles. Although they would not get their vehicles before the deadline, the government has allowed the exemption to be allowed provided the new vehicles are registered by March 31, 2023.

This pushed the June TIV to 63,366 units, an exceptionally high volume as companies rushed whatever stocks they had to customers. The figure could have been higher, had there not bee the shortage of vehicles due to the shortages of chips and components which affected certain makes.

The top 5 brands

The top 5 brands retained their 2021 ranks, with Perodua still leading. While volumes rose, the markets shares of Perodua and Proton decreased, but the market shares of the non-national makes rose.

Higher output from factories

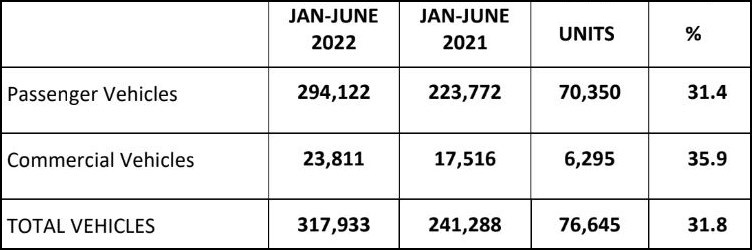

Total production volume in the first half of 2022 also increased likewise by 31.8% to reach a total of 317,933 units compared to 241,288 units in the same period last year. The much higher total production volume seen this year was because there was a total lockdown enforced by the government in June 2021 which shut down factory operations. In addition, the higher output was also in response to the high demand.

Forecast revised upwards

For the whole of 2022, the MAA has raised its forecast to 630,000 units in view of the strong and positive market trend. This is 30,000 units more than the original forecast announced at the beginning of the year. This means that during the second half of the year, monthly saves will have to be at least 49,760 units.

In revising its forecast, the MAA has taken various economic and environmental factors into account as well as drawn on input from its members. The association expects the country’s economic recovery to maintain its momentum and the Finance Ministry is maintaining its official GDP forecast of 5.3% to 6.3% for 2022.

However, there are still some factors that can slow the economic growth, such as geopolitical tensions, escalating oil prices, inflationary concerns, and increases in food prices. These may also make consumers hesitate in making purchases, while business in the auto industry may faced increased logistics and shipping costs and experience supply chain disruptions. Bank Negara Malaysia’s recent decision to increase the Overnight Policy Rate (OPR) by 25 basis points to 2.25% may also dampen consumer confidence.