General Motors (GM) was the market leader in the US market since 1931 but last year, its place was taken not by Ford, Chrysler or even Tesla but by a foreign brand – Toyota. The Japanese carmaker reported sales of 2.332 million vehicles in 2021, beating the 2.218 million units that GM announced the same day. A year earlier, GM had still held No.1 spot with 2.55 million units while Toyota did 2.11 million units, and Ford reported 2.04 million units.

Understandably, Toyota has not played up on its ascent to No.1 position – the first foreign carmaker to do so – since it can be a sensitive issue among Americans. Although it imports many vehicles, it also has huge factories in America that manufacture a number of models there, so they are as American as those from the Big Three with substantial local sourcing of parts as well, not to mention being made by American workers.

But Toyota, like other Japanese carmakers, has been through periods of consumer resentment for their products and at one time, were even forced to voluntarily limit exports from Japan in the 1980s. Starting with a limit of 1.68 million cars (total for all makes) in 1981, the voluntary export restraint brought on by US political pressure remained for some 9 years. While it relieved some pressure on the American carmakers, it also resulted in foreign carmakers setting up factories in America so they could build their cars there, behind the ‘barrier’ and unrestricted by quotas.

Besides the COVID-19 pandemic which affected the whole auto industry, there were also serious supply chain issues and more disrupting, a shortage of semiconductors for the many electronic systems in today’s motor vehicles. Every manufacturer was affected but some, like Toyota, had managed to plan well, which the Japanese are good at. Lessons learnt from the tsunami/earthquake disaster in Japan in 2011 also helped Toyota to have good management of its supply chain and to ensure sufficient buffer stocks for any major disruption.

No plans to boast about title

Toyota doesn’t plan to use its achievement in promotions and instead highlights other sales achievements in 2021 (in the US market) like selling the most electrified vehicles for the 22nd consecutive year, being the No.1 retail brand (which excludes leasing and fleet sales) for the 10th consecutive year, No. 1 in passenger car market share for 10th consecutive year, and the bestselling models in the passenger car category (Camry), midsize SUV category (Highlander), SUV category (RAV4) and small van category (Sienna).

The Honda Accord was the first foreign model to become the No.1 passenger car sold in America in 1989. But the Camry has taken the position most years since 1994, and has been No.1 for the past 20 consecutive years. The success of the model was, in part, due to the refusal of the top guys at Toyota USA to take the model designed in Japan which was too conservative. With the support of the Toyodas, they managed to get the chief engineer to come up with a completely different design which, in some ways, mirrored the Lexus LS400 that had become a benchmark in the US premium luxury class from 1989.

The RAV4 is also another great success story for Toyota in America. It appeared at just the right time as Americans had a growing love for SUVs. Small and as easy to drive as a passenger car, it was ideal for the transition from a passenger car to SUV. It virtually created a new category overnight which would influence the rest of the industry to start following. Three years after the RAV4 appeared, Lexus also did a similar thing in the premium segment with the RX300.

Electrified models fuel sales

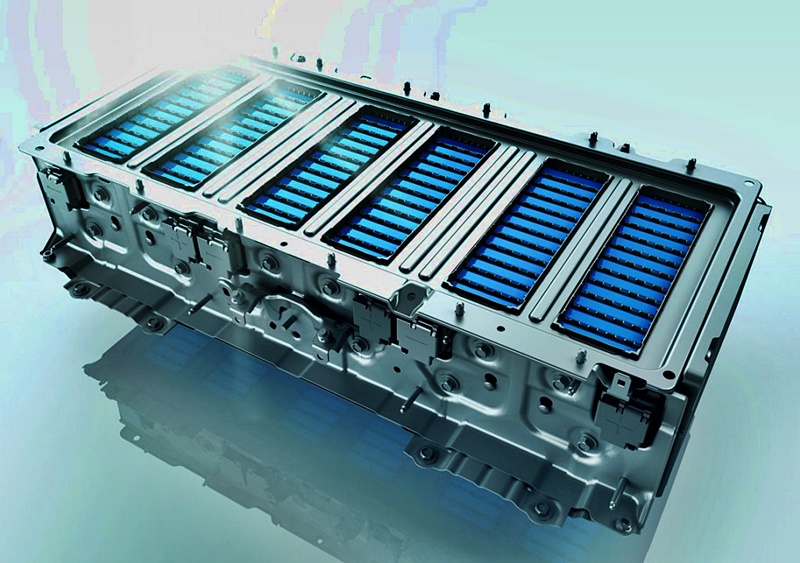

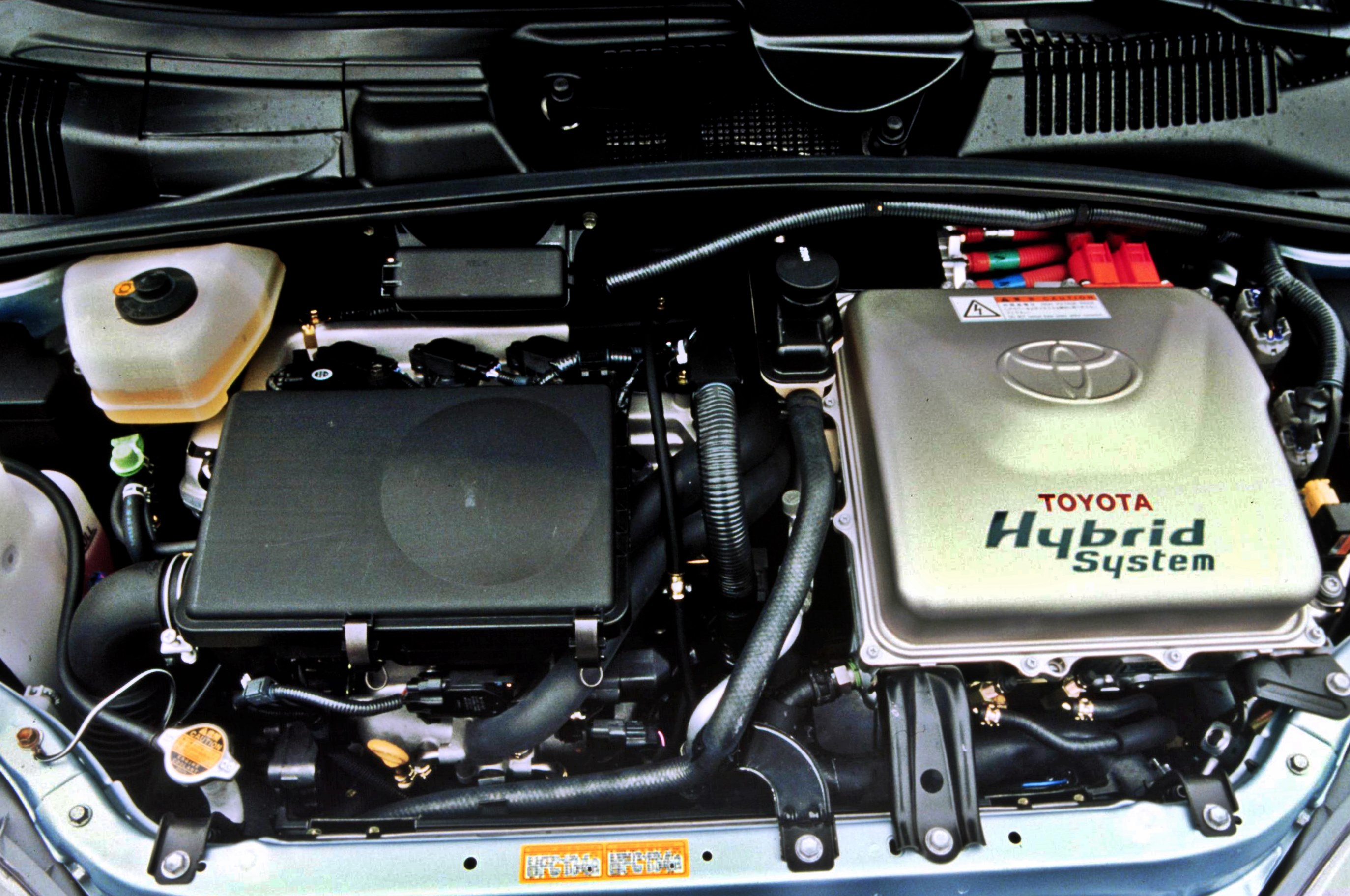

In recent times, Toyota’s growth has been fuelled by electrified vehicles, which it has been selling since the late 1980s when it introduced the Prius as the world’s first mass-produced vehicles with a hybrid powertrain. Since then, the range of hybrid models has expanded and it has even started selling a fuel-cell electric vehicle called the Mirai. Last year, electrified models accounted for about 25% of the total vehicles Toyota sold, up 73.2% in volume from a year before.

The total industry volume was just under 15 million vehicles in 2021 and 2022 is expected to see growth. Some forecasts put it at just over 15 million, but Toyota is more optimistic and thinks it could reach 16.5 million units, of which it is aiming to contribute 2.4 million. Whether GM will regain its crown remains to be seen although, like Ford long ago, the carmaker realizes that it is not much point chasing a No.1 title at the expense of profitability. Toyota somehow has managed to grab the No.1 position while still remaining profitable, though, but the Japanese are always conscious of a rival overtaking them so they never stop looking in the mirror.

Toyota: “No customer is left behind” in quest for carbon neutrality