Victims of the recent floods will face major expenses on repairs and replacing many things. It is going to be a stressful time for everyone, and each will have suffered in varying degrees. Both the government and private sector are doing whatever they can to ease the burden. Apart from providing financial and other forms of aid for the affected, there are also special provisions made for motorists whose vehicles or documents were damaged or lost.

Free replacement of JPJ documents

The JPJ will not charge for replacement of driving licences, Motor Vehicle Licences and Vehicle Ownership Certificates for those affected by the floods. They must however make a police report first which must then accompany their application. Anyone who loses the original documents will need to bring a copy of the police report or Disaster Victim Registration Form issued by the District Office or the Social Welfare Department as evidence.

Meanwhile, the police advise owners of flood-damaged vehicles to make the police reports themselves and not use third parties (such as workshop or tow-truck representatives). They should make sure they have pictures of their vehicles to show the condition as well as the details of the tow-truck company and where the vehicle was taken to.

Specific coverage for floods necessary

While specific flood coverage is needed to make a claim from insurance companies, a police report will protect a vehicle owner so that the workshop and tow-truck company are on record.

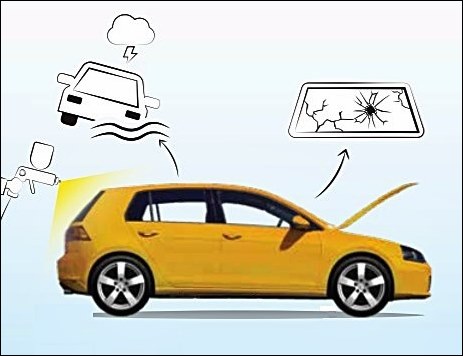

Regarding insurance claims, many will not be able to claim from insurance companies if they do not have specific coverage for flood damage. Such cover is not typically included in comprehensive insurance policies and is an optional add-on for an extra charge. In many cases, motorists regret not doing so and then make sure they add it but unfortunately, the damage is already done this time. So do give serious thought to this additional coverage. It used to be thought that living on the west coast is fairly safe as the major floods are on the East Coast but with climate change and other new conditions, it appears that even the west coast is likely to see flooding in future.

ETIQA waives police report requirement

With any insurance claim, a police report is required to confirm damage and other details which the police will investigate. The same applies to claims for flood damage repairs. However, for motorists who have ETIQA as their insurance company and have Special Peril coverage (which includes floods) with their insurance policy, the police report requirement is not necessary. The owner should take pictures of the vehicle at the scene of flooding and the numberplate must be visible.

This waiver came into effect from December 18, 2021 and will remain effective until further notice. So that’s one less headache if you are an ETIQA policyholder but it is only for those affected by floods.

Allianz goes to affected areas

As for other companies, many have assured their policyholders that they will process claims as fast as possible. Allianz, for example, has positioned Allianz-branded 4x4s and a team of adjusters on stand-by in Selangor and Pahang to attend to customers promptly. The 4x4s and Claims Caravan will be routinely deployed to other locations in other affected states to enable a swift and seamless claims process.

While most will think motorists with passenger cars suffering flood damage, commercial vehicles are also affected. Perhaps the bigger ones might not be damaged but there will be many vans and lorries at depots which are likely to have been flooded. They will need repairs too and being important in the logistics industry, they need to be back in operation as quickly as possible so that much-needed food and other items to help victims can be transported.

Keeping transportation industry moving

“The transportation industry is essential and among the more vital economic activities for a business; having a single vehicle off the road for a period of time would cause some sizeable impact,“ said Arman Mahadi, Managing Director of the Daihatsu Malaysia Group which sells a large number of commercial vehicles.

For this reason, the company has initiated the Daihatsu Flood Relief Program which aims to increase fleet uptime in running an efficient operation and ensuring business remains profitable. “The company is deeply saddened and concerned over the well-being of those hit by the disaster. Therefore, we have a business operation recovery process specifically for our Daihatsu owners and corporate fleet customers,“ he said.

Available to all owners of Daihatsu vehicles affected and damaged by the floods, the Daihatsu Flood Relief Program started on December 22 and will be on till February 28, 2022. Available at all authorized Daihatsu service centres nationwide, owners can get a Towing Service Subsidy of up to RM100, up to 40% off selected spare parts with a 1-year /20,000-km warranty (whichever comes first), 20% off on labour services and free vehicle inspection and Door-to-door Daihatsu Mobile Service. Some terms and conditions apply, and the Mobile Service team is subject to availability and location.

Tips for driving during this rainy season and what you should do if your car is damaged by flooding