Malaysia has long had national automotive policies which are intended to provide a ‘roadmap’ for the development and growth of the auto industry. Updated periodically, it is supposed to give a ‘roadmap’ for companies, especially carmakers, to plan ahead. Investments are often planned many years in advance so policies must be sufficiently long and more importantly, consistent.

In recent times, interest has been on how the government intends to phase in electric vehicles (EVs), in line with the global trend. With Europe, China and Japan putting pressure on electrification, some manufacturers have already declared that they will not only step up development of electrified models but will also stop selling vehicles with combustion engines by the end of this decade.

‘EV roadmaps’ already out in neighbouring countries

Neighbouring countries such as Thailand, Singapore and Indonesia have already provided their ‘roadmaps’ to the industry. The policies announced have provided sufficient information for the carmakers to plan their investments which will be considerable.

Malaysia has said it has an EV policy and will announce it in due course, so the industry waits. A clear policy coupled with incentives will certainly attract investments to supercharge EV adoption by the masses, according to industry players speaking at Maybank Kim Eng’s ‘The Rise of ASEAN EV’ webinar recently.

Clear timeliness will bring investments

Having clear timelines for EV adoption and phasing out of internal combustion engine vehicles (ICEVs), incentives for EVs and also introducing disincentives for ICEVs will increase the demand for EVs. Investments will follow suit, including those for building the charging infrastructure and stability of power supply.

Citing Norway’s experience, Eirik Barclay, Group Executive Vice-President, New Ventures and Technology, Yinson Holdings, said that there was never a subsidy for EVs. Instead, the government increased taxes on ICEVs and fuel. This also meant that the government did not lose revenue. He believes that these measures, and the removal of fuel subsidies, will result in consumers choosing EVs over ICEVs due to cost of ownership.

Comprehensive charging infrastructure needed

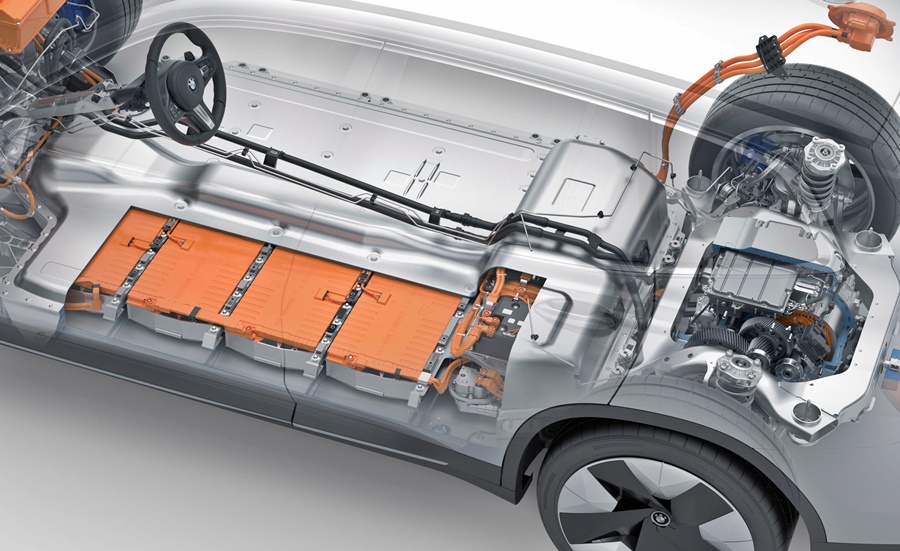

Range anxiety remains a concern among consumers, this referring to the distance that can be travelled on a fully charged battery pack before it needs to be recharged. However, studies have found that most do not usually drive more than 100 kms on a typical day and most of today’s mass-produced EVs can already provide that range and more. This concern can be mitigated with a charging infrastructure that is well planned and comprehensive.

Lee Yuen How, Director, EV Connection Sdn Bhd said that all stakeholders such as automakers, oil and gas companies, utility companies, chargepoint operators, and the government should work together to build the infrastructure.

“If you leave it to the private sector, they will only build the charging infrastructure where there are high concentrations of EV users, leaving the semi-urban and rural areas to become an ‘EV-charging desert’. Therefore, the government plays an important role in ensuring investment across all areas,” he added.

Responsibility for used batteries

Jinsi Lee, Founder & CEO of Oyika, advocates a separation between the battery pack and the electric vehicle for environmental and regulatory benefits. “The party that sells the vehicle must be responsible for the battery across its entire lifecycle, instead of transferring ownership to the vehicle buyer. The seller will be required to take the battery pack back, recycle it and reuse it as second-life storage, decommission it and so on,” he said.

“From a consumer’s point of view, if the battery pack is leased, then one can buy a second-hand EV and still get the latest battery technology. We are doing this for motorbikes and I don’t see why we can’t do it for vans, trucks and cars,” he added.

Maybank Kim Eng Research predicts that sales of EVs will reach parity with ICEVs by 2030, driven by the global carbon neutrality agenda and millennial consumer preferences, among others. Malaysia and the Philippines are the slow ones in the EV race in ASEAN. Malaysia’s Low Carbon Mobility Blueprint is an important catalyst; however more focus should be on battery EVs (running only on electricity) instead of plug-in or hybrid EVs to be fully on the carbon neutrality agenda.

During the webinar, it was also suggested that ASEAN should look at China and pure-EV companies for partnerships and investment, and pursue green technology such as hydrogen at the same time.