The Malaysian auto industry, like many other industries in the country, has been badly impacted by the measures taken to fight the COVID-19 pandemic since last year. Representing the new motor vehicle distributors, assemblers and manufacturers, the Malaysian Automotive Association (MAA) commends the government for its efforts to contain the spread of the coronavirus in order to save lives.

However, the MAA feels the Enhanced Movement Control Order (EMCO), Phase 1 and Phase 2 of National Recovery Program approach needs to be reviewed and re-considered, especially for key economic states like Selangor, Wilayah Persekutuan Kuala Lumpur, Perak, Johor, Penang and Negeri Sembilan. The EMCO approach had been enforced in Selangor and WP Kuala Lumpur for more than 2 weeks now while some states have transitioned into Phase 2 of the NRP.

Whole supply chain affected

“The whole supply chain in the automotive sector has been seriously affected particularly by the complete shutdown of operations in EMCO states/localities like Selangor and WP Kuala Lumpur. Feedback received from many of our members indicated that business operations – even in non-EMCO states – are hampered due to disruptions in the supply chain”, said Datuk Aishah Ahmad, President of MAA.

During the EMCO stage, not a single business activity from the automotive sector is allowed to operate, while for states under Phase 1 and Phase 2 of the NRP, the vehicle showroom and distribution centres are still not allowed to operate despite the opening up of most of the other economic sectors.

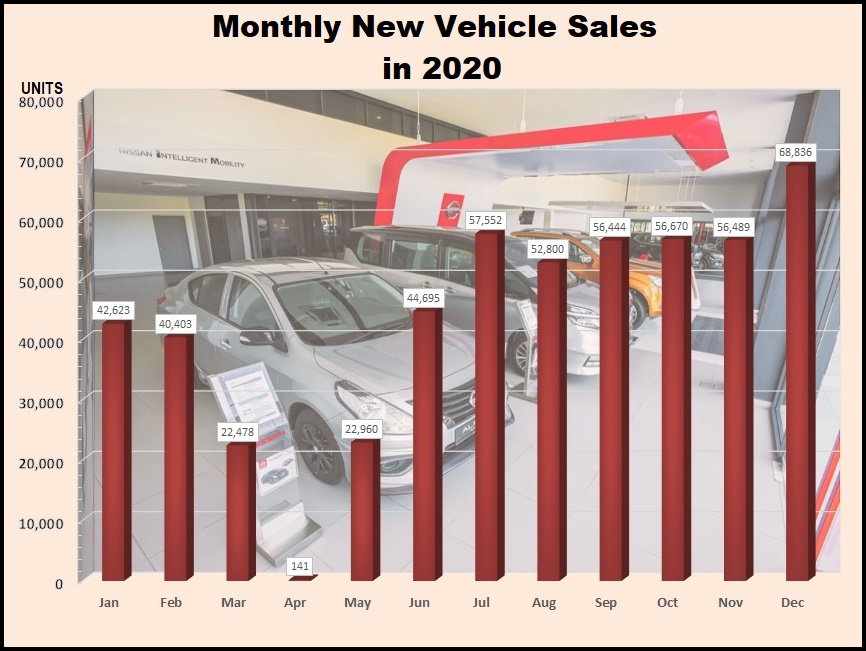

Production and distribution of automotive products (motor vehicles, components and parts) and sales of vehicles have been halted since June 1, 2021. The stoppages of all these activities will have far-reaching implications to the entire automotive ecosystem nationwide. In April last year, sales and production plummeted to almost zero when the first MCO was in force.

Implications of continuing closures

While automotive companies may suffer from loss of revenue, profitability, export markets and closure of businesses, their employees face issues such as pay cuts, loss of income (particularly for sales personnel) and even retrenchment in certain cases. The government will also lose in terms of lower revenue collected from excise duties, import duties, sales taxes and road taxes for motor vehicles.

The closures of automotive workshops and parts centres in EMCO states/localities such as Selangor and WP Kuala Lumpur will not only cause inconvenience to all vehicle owners in general but may also endanger those whose vehicles may have defects or problems. Failure to repair faulty parts in such vehicles can pose a serious risk to all road-users. These include vehicles which may be belonging to frontliners such as those in the PDRM, Ministry of Health, etc. who may encounter damages or breakdown in the course of doing their work.

With factories and distribution centres (for vehicles and parts) in EMCO states/localities unable to operate, this will disrupt the supply chain to business operations in states/areas under Phase 1 and 2 of the National Recovery Plan (NRP). As a result, the recovery efforts by the government will be negated.

Increasing damaged inflicted

The consequences arising from stoppages of the automotive factories, workshops, and distribution centres (for vehicles and spare parts) in EMCO states/localities is indeed very serious, the MAA stresses. The longer these facilities do not operate, the greater the damages inflicted on to the automotive industry in particular, and the country in general.

The MAA is therefore appealing to the government to allow automotive sector activities (workshops and distribution centres for passenger and commercial vehicles and spare parts) to operate with immediate effect albeit at certain capacity and with strict SOPs in place in states under EMCO, Phase 1 of NRP and Phase 2 of NRP.

Selangor and WP Kuala Lumpur account for close to 50% of Malaysia’s total industry volume of new vehicles each year. Many of the key automotive companies for both production of vehicles and components are located within these two states. In addition, some MAA members also have their sole and or central distribution centre (for vehicles and spare parts) located within the Klang Valley.

In addition, to reduce congestion at ports, the MAA is proposing to allow a window of two to three days per week for receiving and storing cargos for the automotive sector similar to what was practiced during MCO 1.0 last year. The Malaysian automotive industry is heavily dependent on the domestic market. Export markets exist but are insufficient to sustain the industry.