The severity of the COVID-19 pandemic forced governments to put their countries into lockdown, which meant that industries and businesses had to close. Malaysia didn’t escape the economic downturn that resulted, though good management at the start helped to bring the numbers down and the situation under control. This allowed the country’s economic sector to restart and slowly recover, aided by a recovery program which covered many sectors.

For the Malaysia auto industry in modern times, 2020 was the worst year in its history which goes back to the 1960s when the first local assembly of vehicles began. There had been a few recessions but even though they were challenging with a contraction of the market, there wasn’t a total shutdown as was experienced last year. Activities could still continue and each company had its own strategy to weather the downturn, which veterans knew would pass. And while there was loss of jobs, there wasn’t the fear of death or sickness too.

PENJANA was a big help

The PENJANA program by the government to help the economy recover began in the middle of the year and for the auto industry, the support given was in the form of exemption of the 10% sales tax, reducing the price at point of purchase. It was a straightforward incentive – 100% of the tax for models assembled locally (CKD), 50% for those imported CBU (completed built up).

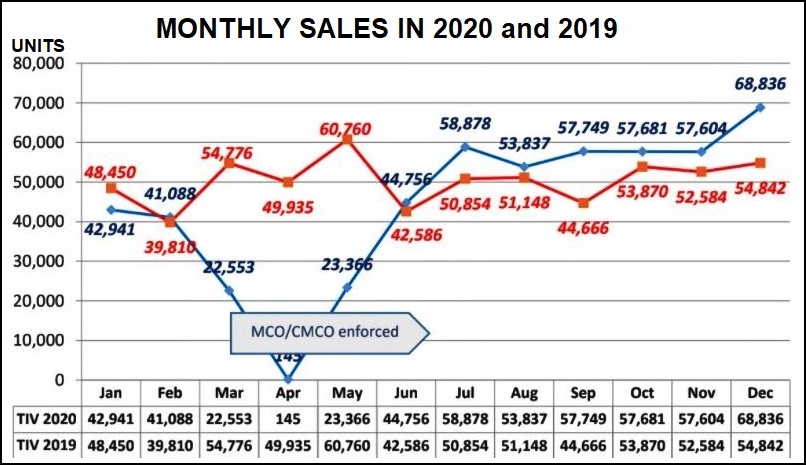

The incentive worked well as sales quickly rose and stayed above 50,000 units a month during the second half of the year. In fact, the final quarter was exceptionally strong, averaging 61,373 units a month compared to 53,765 units a month for the quarter before.

Consistently high numbers in second half

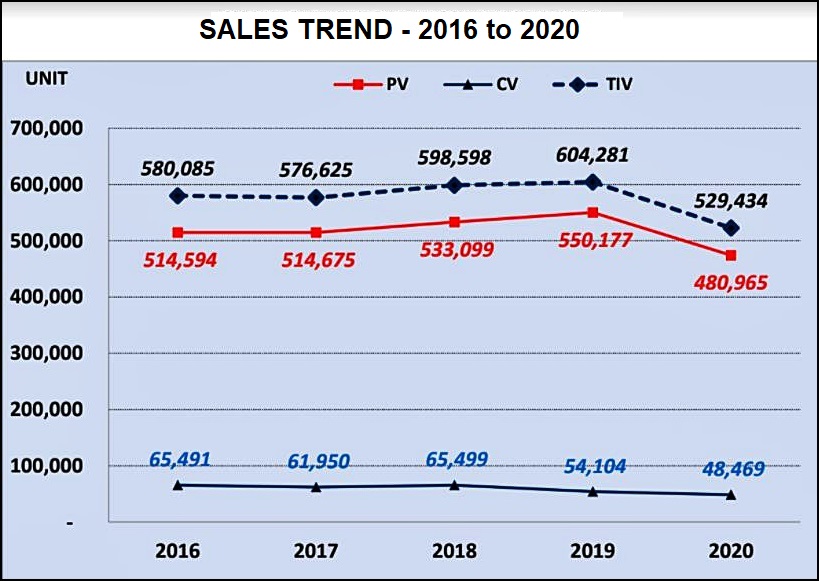

Nevertheless, the Total Industry Volume (TIV) for 2020 was expected to be lower than the 604,281 units recorded in 2019 and in the first half of the year, many would have expected it to be significantly lower. However, with the consistently high numbers in the second half of the year, the TIV closed at 529,434 units, 12% lower than 2019 but well past the forecast of 470,000 made by the Malaysian Automotive Association (MAA).

However, when the year had started, the MAA had actually forecast 607,000 units for the year, but revised it substantially downwards by 23% as the seriousness of the pandemic and its impact on the industry became clear.

The monthly TIV reached its peak in December 2020 when a total of 68,836 units were registered. The exceptional high TIV in December 2020 was due to consumers buying forward in anticipation that the tax exemption incentive (only for passenger vehicles) expiring on December 31, 2020, as original announced. However, it has been extended to June 30,2021.

“MAA would like to express our heartfelt and sincere appreciations to the government in general and the Ministry of Finance and Ministry of International Trade & Industry in particular for listening to the industry’s plights and providing us with all the supports (especially the PENJANA package incentive) to ensure the continuance of business activities and the survival of the industry,” said Datuk Aishah Ahmad, President of the MAA.

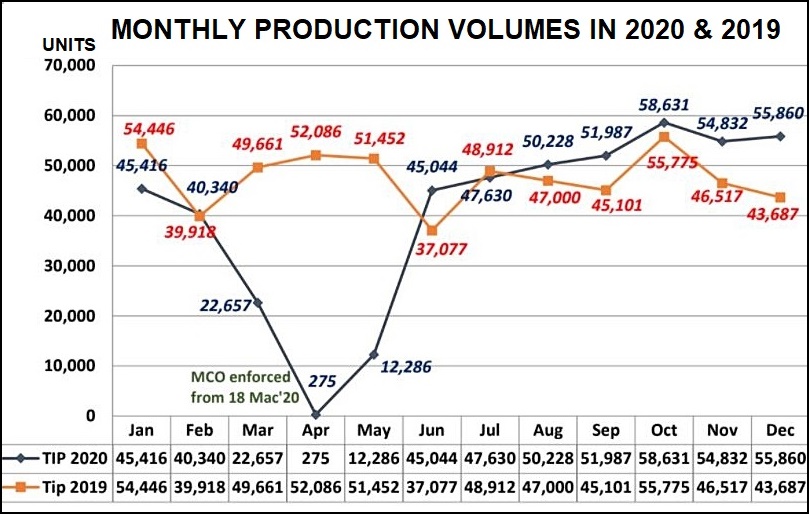

By segment, passenger vehicles (excluding pick-ups) declined by 12.6%, which was higher than for commercial vehicles (including pick-ups) which declined by 10.4% Production of new vehicles in 2020 seemed to be impacted by the forced shutdown of every factory in the country for about 2 months but when allowed to resume operations, the carmakers worked harder to meet not only outstanding orders (for high-volume brands like Perodua and Proton) but also increasing demand in the second half of the year. By year-end, the production volume was 15% lower than the output in 2019.

Looking ahead

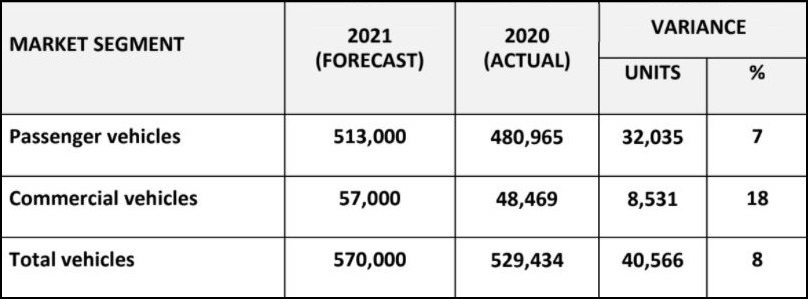

As always, the MAA takes feedback from its members and also factors in economic and environmental situations when looking ahead. It is optimistic that 2021 will see the local economy recovering in tandem with the global economy, which can boost sales. Certainly, the continuation of the sales tax exemption will help, along with more consumer confidence to spend on items like new vehicles.

Lower hire purchase (H-P) interest rates will also help, complemented by the introduction of new models which the companies will be offering at prices that will be ‘in tune’ with the times. While the industry may have come to a standstill in one sense, activities continued behind the scenes and whatever projects were underway would have only been slightly delayed.

So, for 2021, the MAA is forecasting an increase of 100,000 units from its 2020 forecast, which is 8% higher than the actual TIV achieved. Strong growth (18%) is expected in the commercial vehicle segment which will continue to require vehicles for the various projects underway around the country.

Looking further ahead, it appears that the MAA expects the strong demand to continue into 2022 with an increase of 6% to take the TIV past 600,000 units again. Thereafter, from 2023 – 2025, growth will be at a slower rate of 3% to 3.2% annually. Hopefully, the pandemic will have diminished significantly and normalcy has returned.