Since the Movement Control Order (MCO) was introduced in March 2020, motoring has reduced for many people. Apart from the periods when interstate travel was forbidden, commutes to work are also less with work-from-home (WFH) still in effect and schools have been closed. Furthermore, to reduce spread of COVID-19, the authorities urge people to remain at home more and only travel out for essential purposes.

This means that motor vehicles are being used less and as the mileage is lower, the question which the good people at Aurizn Malaysia wondered is whether insurance premiums could be reduced in this situation.

First mileage-based car insurance plan

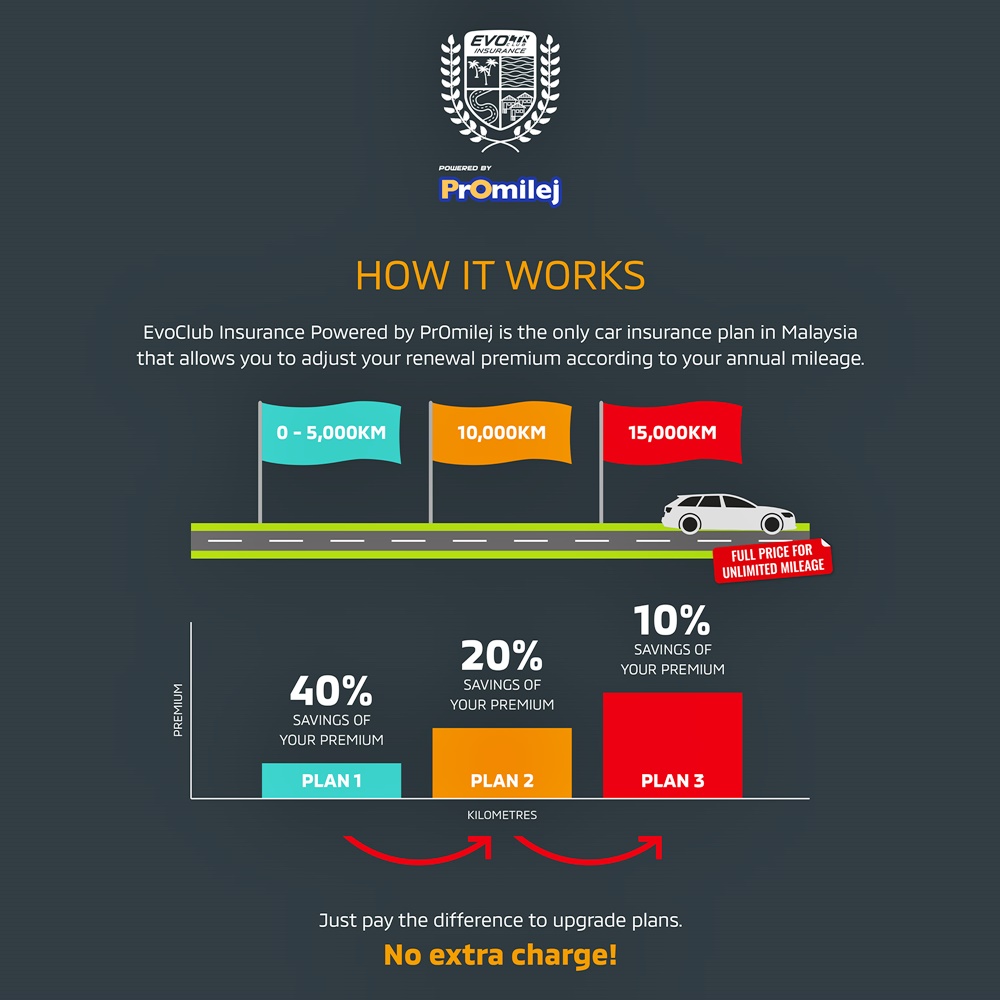

As the insurance industry has been progressively deregulated, it is now possible for insurance companies to vary premiums and Pacific & Orient Insurance Co. Bhd (POI) is willing to do so with what is the first mileage-based car insurance plan in Malaysia. Conceived in partnership with Aurizn Malaysia, it is known as the EvoClub Insurance Powered by PrOmilej and offers motorists unprecedented savings and flexibility

The benefits, which would be especially welcome in this challenging period, are as much as 40% savings on car insurance premiums as well as flexibility to make payments in up to 3 parts without incurring additional charges.

Three plans

The pioneering ‘pay as you drive’ concept allows motorists to start off with Plan 1 that offers 40% up-front savings for an allocated mileage of 5,000 kms. Plans 2 and 3 offer 20% and 10% savings for 10,000 kms and 15,000 kms mileage limits, respectively. For maximum flexibility, consumers can easily upgrade plans by simply topping up the difference between them. Each policy is allowed a maximum of two top-ups.

“We are very proud to have this opportunity to partner with POI to bring this innovative insurance product to Malaysian motorists and car enthusiasts. Firstly, low-mileage cars can enjoy significant savings on insurance costs, and you get to multiply these savings if you own multiple cars,” said Bobby Ang, Editor-in-Chief of Aurizn Malaysia.

“And because this plan offers the flexibility of upgrading between plans twice a year without incurring extra charge, consumers can use this to stagger their car insurance to a maximum of 3 payments by just paying the difference between plans. We feel these options come in very handy as we navigate the challenges of this pandemic with many of us now travelling less and some even earning less as well,” he added.

For motorists that exceed the allocated mileage without topping up, the policy will continue to cover for third-party bodily injury or death and third-party damage only. This ensures that the vehicle continues to receive the minimum required coverage for the vehicle that is required by Malaysian law to remain road legal by the Road Transport Department (JPJ).

Online applcations accepted

Interested in this money-saving approach to insure your vehicle? You can do so easily online (www.evoclubinsurance.com) or via POI’s toll-free line 1-800-88-2121. The only additional step required in the buying process compared to other insurance plans in the market is to upload a picture of the car’s odometer to the website. A vehicle inspection is not required.

EvoClub Insurance Powered by PrOmilej is another initiative of EvoClub created to give motorists a whole car buying and ownership experience. Complemented by the meticulous car reviews of the EvoLTN editorial team to serve as buying advice, other services offered through EvoClub include used car pre-purchase inspection service, Extended Warranty, and trusted workshops.

“Our ultimate aim is to create an ecosystem where we help car buyers and owners every step of the way by starting from car buying advice and then providing a support system that takes care of all their car ownership needs,” Bobby said.