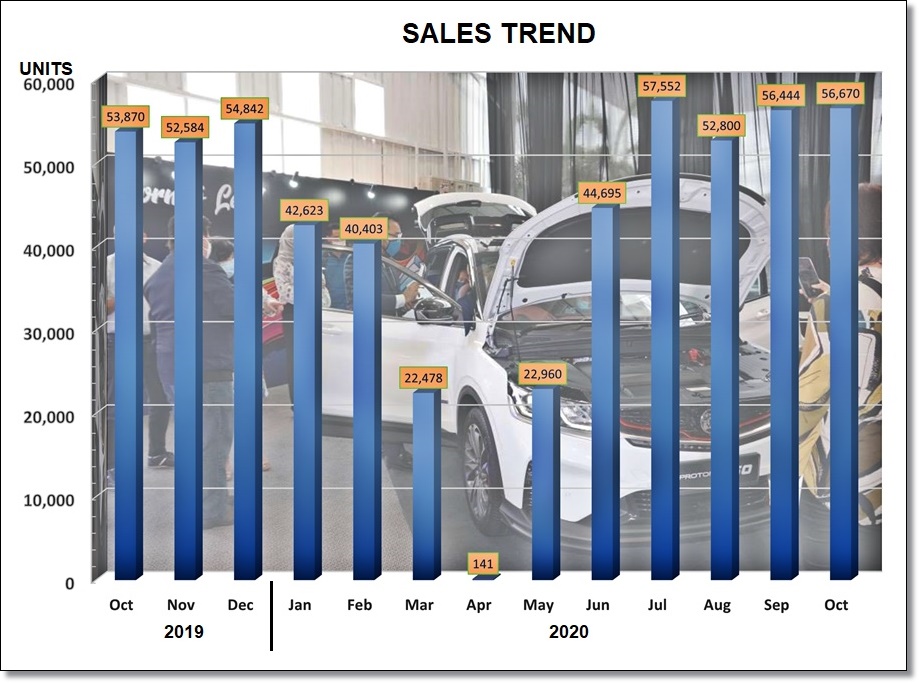

♦ The upward trend seems to have flattened out with October’s Total Industry Volume (TIV) less than 1% higher (226 units) than the TIV for September. No doubt, the reduction in the cost of buying a new vehicle due to the government’s Sales Tax exemption incentive still helps encourage sales and when compared to the same month in 2019, this year was 5.2% better.

♦ The TIV for the period from January to October has almost reached 400,000 units, reached 398,159 units to be exact. With two months remaining to hit the MAA’s 470,000-unit forecast for 2020, can the monthly TIV for November and December average 36,000 units? Since July, it has been above 50,000 units.

♦ Of the 56,670 units registered, 86% were passenger vehicles (excluding pick-up trucks).

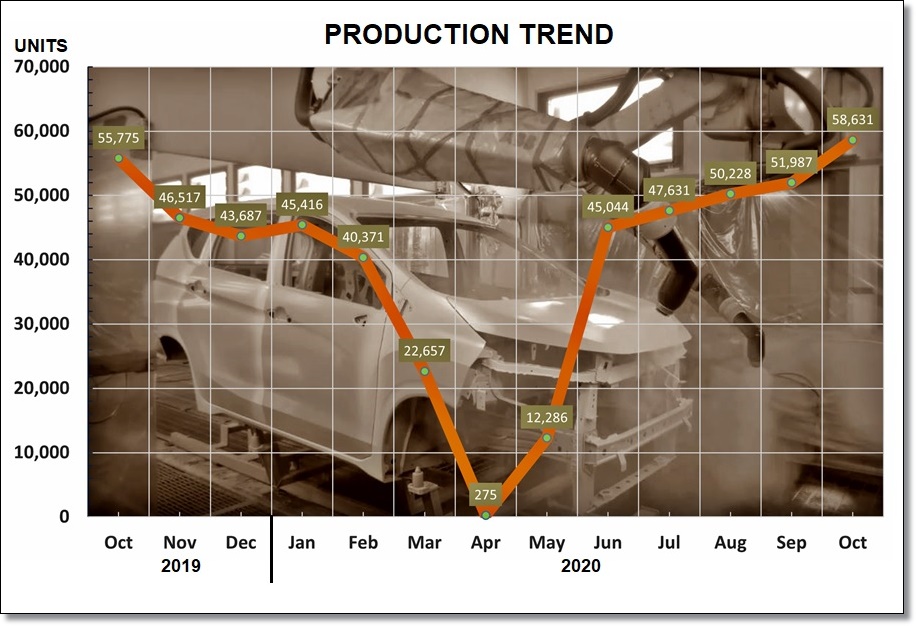

♦ The output from the plants rose more substantially to 58,631 units in October to meet the higher demand and to also build up stocks for the end of the year period. It is likely that December will see a rush to take delivery so as to enjoy the sales tax exemption, This would be unusual as many customers often want to defer to the new year.

♦ One thing that could dampen sales a bit would be the uncertainty surrounding the COVID-19 pandemic. While the government is reluctant to impose a full-scale MCO like what we had in March and April when businesses had to shut down completely, there may be areas where stricter conditions are imposed, especially in the Klang Valley where there is the largest number of vehicles sales.

♦ The MAA does expect some softening of the market in the light of a broader impostion of the CMCO and says that members have reported a slowdown in showroom traffic. Nevertheless, many companies now have online facilities for customers to know more about products and then make bookings as well, so at least the initial phase of transactions has been addressed in the ‘new normal’.