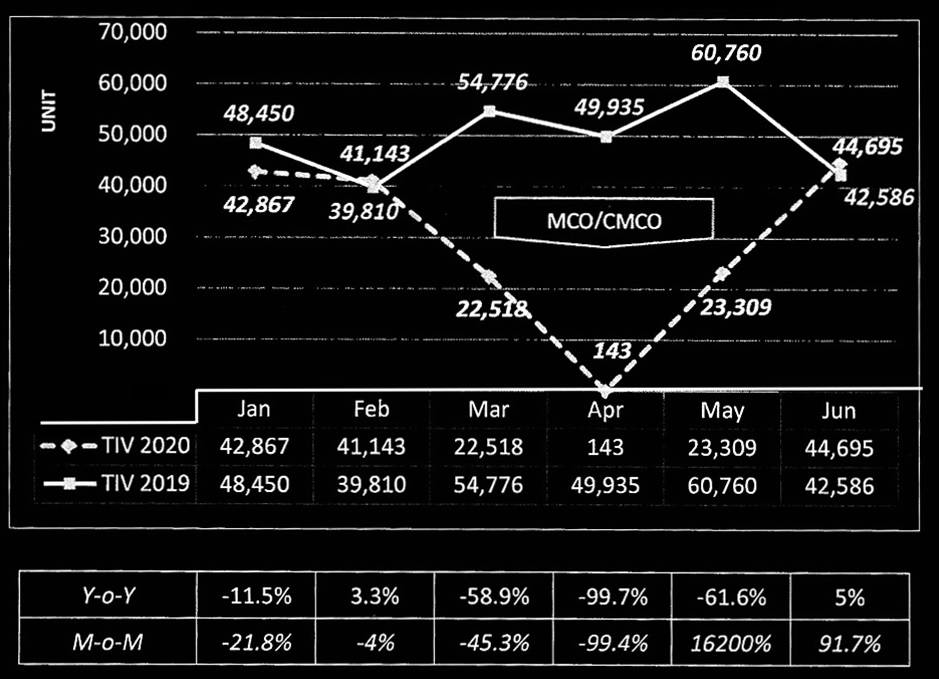

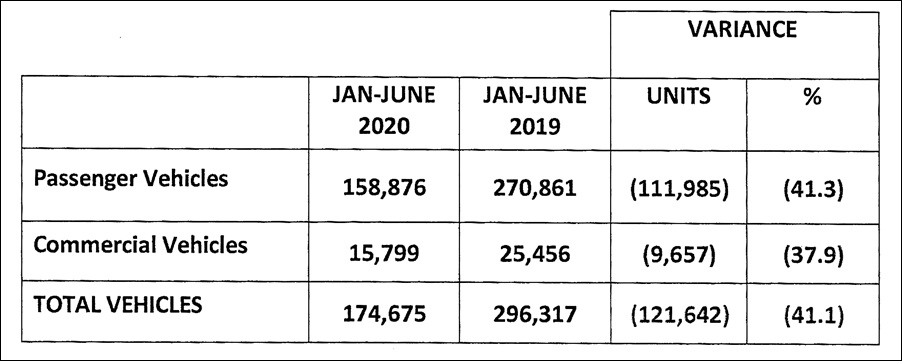

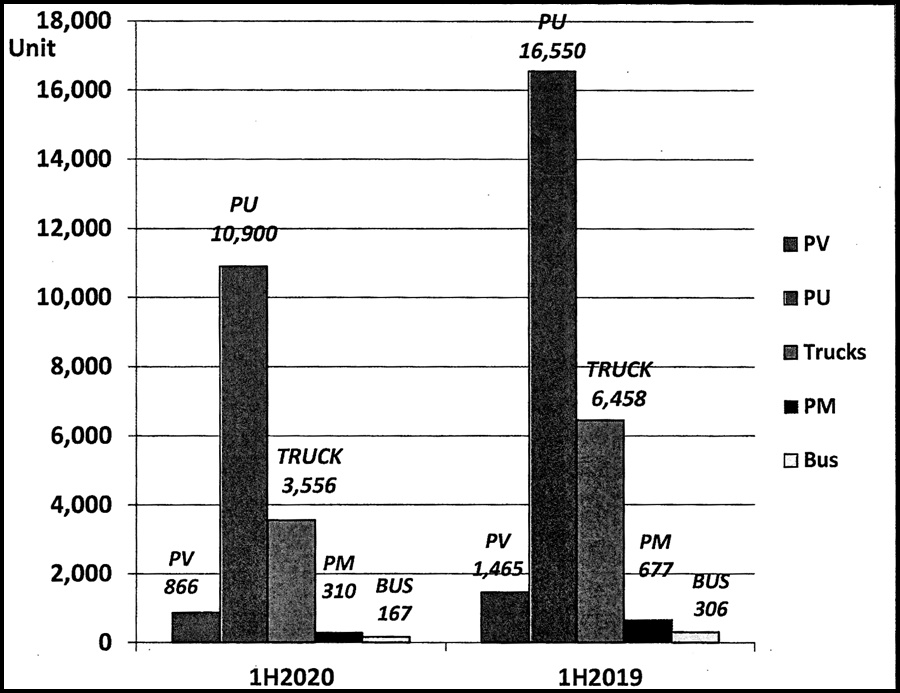

The official numbers are out and as expected, they show a grim picture of the auto industry’s performance in the first 6 months of this year. For the first half (H1) of 2019, the Total Industry Volume (TIV) was almost 300,000 units but this year, it fell by 41.1% to 174,675 units.

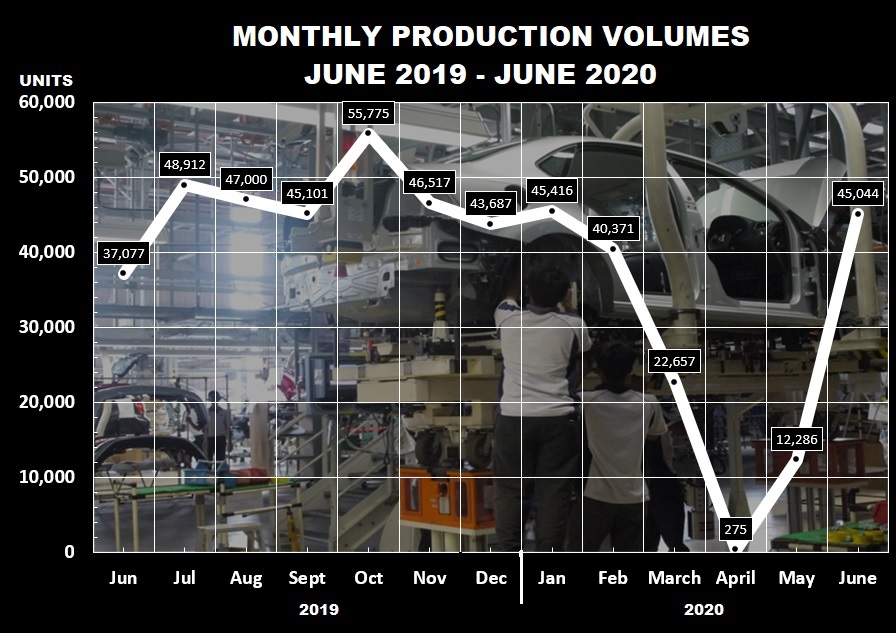

As the chart shows, the unprecedented contraction started in March when the Movement Control Order (MCO) was implemented in the middle of the month and the slide continued through April with a 99.7% drop compared to April 2019 as no business could be done. By May, the situation shows signs of improvement that the government was willing to relax the MCO and allowed many businesses to resume operations, with strict Standard Operating Procedures (SOPs) to be observed.

The resumption began with service centres and factories and then showrooms were also allowed to open for business. While large numbers of customers didn’t visit showrooms, many companies began to promote their online services for booking which at least started the purchasing process without having to physically be in contact with the customer.

May saw a climb in numbers to 23,960 units and then came some good news that was part of the government’s plan to help industries recover: the sales tax of 10% would be exempted from June 15 to December 31, 2020. For locally-assembled models, which make up the dominant share of new vehicles sold, the exemption would be 100% and for imported CBU models, it would be 50%. It was hoped that the lowering of prices would encourage people to buy new vehicles.

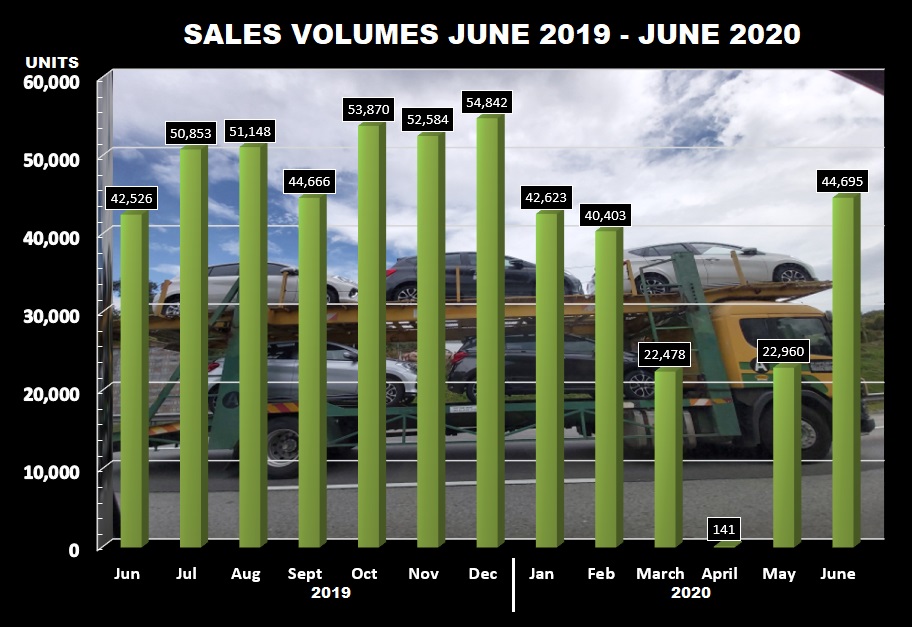

Even with just two weeks in June when the prices were reduced (although Perodua started adjusting prices downwards a bit earlier), sales shot up by 91.7% from the May TIV to 44,695 units – even higher than the 42,526 units reported in June 2019.

2020 forecast revised twice

When the MCO was in force and its impact on the industry was clear, the MAA revised its forecast for the year downwards to 400,000 units. Then, when the government announced the exemption of sales tax, the forecast was revised again as it was felt that the auto industry-specific incentive, along with other economic incentives, would help to boost sales. The revision saw the TIV for 2020 going up to 470,000 units.

This means that, for the second half of the year, the TIV would have to be 295,325 units or almost 50,000 units each month. That may appear a bit ambitious but last year, 5 of the six months in the second half of the year saw volumes over 50,000 units. However, consumers were uncertain about the economy then, not their lives; it is different this year with concerns about COVID-19. Many people have lost their jobs (the unemployment rate increased to 5.3% in May from 3.3% in February) or had big pay cuts and buying a new vehicle might be one of the last things on their mind.

Used car business booming

The used car industry is experiencing a boom, though. According to MAA President, Datuk Aishah Ahmad, apart from wanting to spend less on a vehicle purchase (or not at all), many people may be reluctant to use public transport to avoid risks of infection and therefore buy a low-priced used car for their transport needs.

Obviously, the auto industry would like more assistance from the government to help in its recovery but understandably, the government has to help other industries as well. The new National Automotive Policy (NAP) which was announced at the beginning of the year has yet to be implemented and the MAA will soon be meeting MITI to get more clarification on the policy as well as to offer suggestions on how the industry can be helped in its recovery. The MAA President thinks that the policy is unlikely to be changed despite the challenging economic conditions.

Other ASEAN markets

As always, the MAA press conference also included an overview of how other ASEAN markets are doing and as would be expected, there was a big drop in the total regional sales and production volumes by 42% and 39%, respectively. Only Myanmar did not have a decline in sales (in fact, its sales increased by 5%) during the first 6 months of 2020 but that market is small – less than 8,000 units over a 5-month period. Compared to the 5-month period in 2019, production in Thailand and Indonesia, the two big markets which also export substantial numbers of vehicles, dropped by 40% and 33%, respectively, while Malaysian production was 51% down.

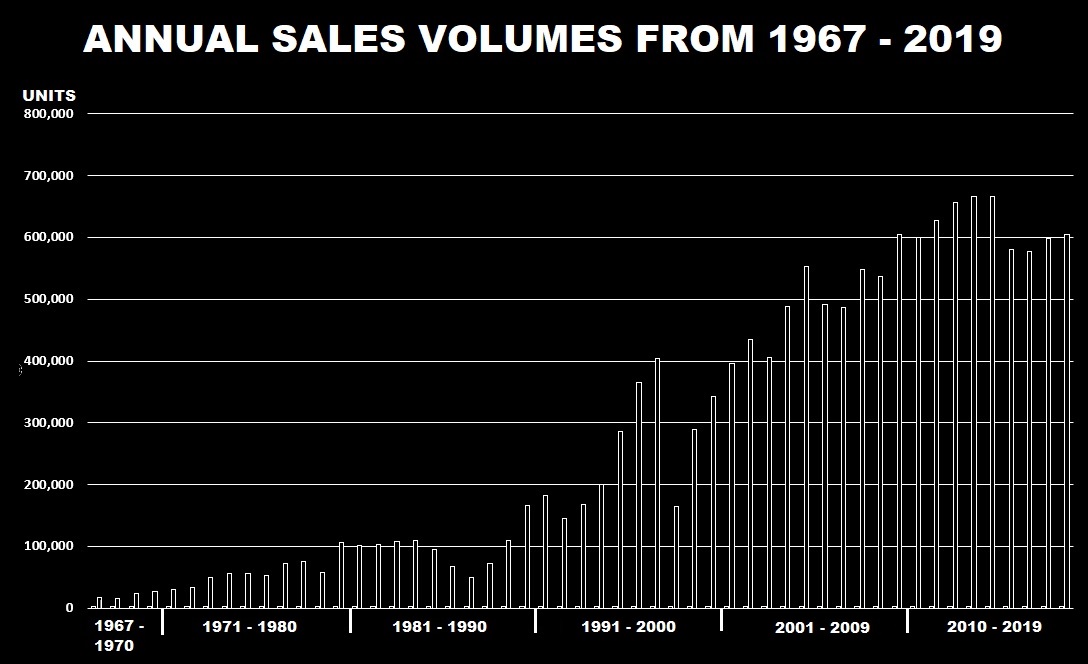

After 2020

The MAA’s forecast for the next few years is conservative and as the TIV for 2020 is going to be lower than normal – the last time it was around 470,000 units was in the early 2000s – 2021 is expected to see a 17% increase to 550,000 units. However, after that, the TIV may slow down and a 9.1% increase to 600,000 units is forecast for 2012. Thereafter, it may be just 2% a year till the end of 2024.

At this time, it’s hard for anyone to say with certainty how things will be. As the International Monetary Fund (IMF) has said, ‘the trajectory of the pandemic remains hard to predict’. Unlike economic recessions where business drops but when things get better, it picks up and continues to grow. This pandemic situation is like a world war, with devastation including loss of lives as well, that impacts virtually everything and with the economies so interconnected, every country will be affected.